| olivier godechot |  |

Godechot Olivier, 2015, « Resurgence of Capital or rise of the Working Rich? On Piketty’s Capital in the 21st century », Crooked Timber.

-

An earlier version of this was published in French as Godechot Olivier, 2015, “Le capital au XXIe siècle, T. Piketty.” Le Seuil, Paris (2013). 970 pp., Sociologie du travail, vol. 57, 2, p. 250-253.

Capital in the Twenty-First Century was a classic as soon as it was published.1 It deserves a place on bookshelves beside its illustrious namesake of the 19th century. Capital, in Capital, is the wealth of nations. It extends beyond firms’ traditional productive capital to encompass the entire public and private patrimony that can be sold on a market (thus excluding non-transferable forms of capital such as human, cultural and social capital). The book is the culmination of fifteen years of individual and collective research on the evolution of income and wealth inequalities. Thanks to data based on the collection of income tax, Thomas Piketty and his colleagues had already widely explored income inequality in France, the United-States, India, China, and more generally in the world by the early 2000s, fuelling a unique and remarkable dataset: the World Top Incomes Database. However, this work focused on income rather than wealth, and hence provided an incomplete account of economic inequality. This new book fills in this gap in a very timely fashion.

The thesis of the book could be summarized as follows: the simple fact that the return on capital is durably higher than the economic growth rate feeds implacable dynamics of inequality.

Under these conditions, the relative share of capital (as measured by the national wealth to GDP ratio) increases inexorably. Far from being exceptional, this configuration is currently the norm. Since the 1970s, the decline in the growth rate which is a combination of the decline in the population’s growth rate and that in individual productivity, have helped capital come back. In France, the amount of total wealth owned by all public and private actors has gone from a little less than four years of income in the 1970s to more than six in the 2010s.

This resurgence of capital promotes increased inequality in several ways. First, wealth is very unevenly distributed, with the poorer half of the population holding less than 5% and the top 1% holding 25%. The global increase in asset prices thus tends to help the latter. Second, ability to save, and hence to accumulate wealth, increases with income. Third, the higher the wealth, the greater the return on capital, thanks to better financial advice, a weaker preference for liquidity and a greater ability to bet on more remunerative (albeit risky) long term investments. Meanwhile, the increase in wage inequality, due to the emergence of “super-wages” for an elite of CEOs and finance professionals, enables newcomers to find a position among the wealth elite without weakening this elite’s domination.

After reaching a low point in 1970, wealth inequality is on the rise again. The share of national wealth owned by the top 1% increased from 28% in 1979 to 34% in 2010 in the United States, from 23% to 28% in the United-Kingdom and from 22% to 24% in France. It is still a long way away from the concentration of wealth in the early 20th century where the top 1% had 60% of national wealth in France and 70% in the UK. However, Capital warns us that we may be on our way back to that world if the dynamic of inequality is not halted. According to Piketty, progressive taxation of income and capital (on the level of global regions to limit the problem of tax competition) could set the net return on capital below the economic growth rate and halt the inequality dynamics.

But the book goes far beyond a simple demonstration of the unequal logic of capitalism and the merits of redistributive taxation. It is a remarkable multidisciplinary work on the economic and social history of Western capitalism and inequalities, thanks to a combination of serial statistics and specific examples from literature, film, political history and history of economic thought that illuminates both past events and perceptions. Wealth is the gateway to a new understanding of two centuries of economic, social and political history. The opposition in the nineteenth century between the Old World, dominated by past wealth (with a capital equivalent to seven years of income) and the New World, less subject to such a legacy (with a capital of less than five years of income) is particularly striking. So is in the opposition in the New World between the North of the United States and the South, where slave ownership gave capital a preponderance similar to that measured in Europe at the same period. The shocks of economic crises and inflation peaks, the impact of fiscal policies, sometimes offensive, sometimes accommodating, and moreover the destruction of wars greatly shape the importance and the role of capital.

The book sometimes adopts a Braudelian tone, highlighting deep structures of capitalism, such as the growth rate, that are unbudging and impossible to guide. The decades of growth in the postwar era is an exceptional stage that is futile to feel nostalgic for and try to return to, since it was largely a phase of reconstruction and catch-up. After reaching the technological frontier, growth can only continue in the 21st century at its long-term rate of 1 to 1.5% per year (of which half is due to population growth). It seems slow when measured year by year, but it is very fast and almost unbearable at the scale of centuries. In addition to the growth rate, other factors such as the savings rate, share of value added, and return on capital are also immobile or slowly changing variables that seem to defeat any kind of political action. If these quantities, which are the product of a kind of extended general equilibrium, are not controllable, states still retain their two original powers to shape capital accumulation and its unequal consequences: wars (which one cannot want) and taxes.

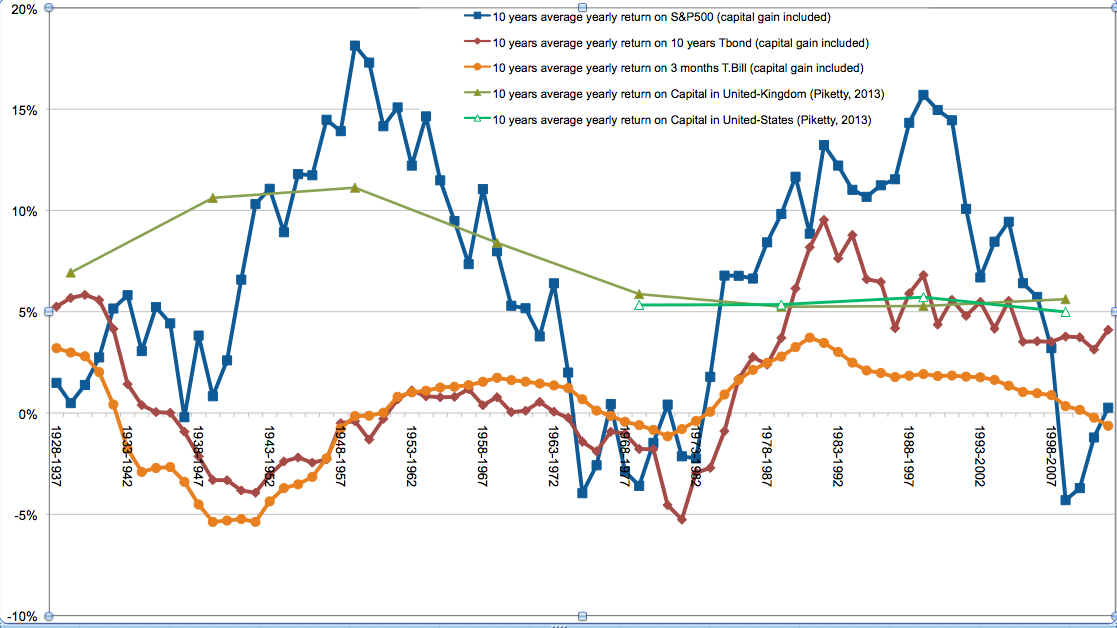

Although the book contains many impressive and valuable statistical series, it takes some risks in its treatment of the largely unexplored topic of wealth. These first estimates will benefit from being evaluated, tested, and corroborated by later work. For example, the return on capital, which the author believes to be stable at around 5%, is calculated from aggregate data from national accounts and defined as the ratio between the share of capital in the value added from the income accounts and the estimated value of the national capital in the wealth accounts. Given the numerous conventions that govern the construction of these data, the reconciliation of the macro approach with a micro approach might add a lot, all the more so as the performance of listed shares varies considerably even in the medium-term. The ten-year yield (including capital gains) of the S&P500 (the index of the New York Stock Exchange) is greater than 10% between 1940 and 1960 and between 1980 and 1992, while it is negative or zero between 1965 and 1975 or since 2000 (Figure 1). These significant variations in performance at the micro level leads one to ask whether the resurgence of capital is due to the inexorable mechanics of capitalism or rather a product of contingent financial and real estate bubbles, and more generally due to the phenomenon of financialization. Answering this question could tell us whether, in addition to fiscal policy, a sector-based economic policy of “definancialization” could also contribute to fight inequality.

Figure 1. Comparison of the return on capital over ten years calculated by Thomas Piketty and that on some US famous assets. Note: A portfolio replicating the S&P500 purchased in 1949 and sold in 1958 provides a real annual return of 18% per year (capital gains included).We discount changes due to inflation. Sources: Thomas Piketty’s data is available here; those on yields of major US national assets here.

While the early work of Thomas Piketty and his colleagues focused mostly on income inequality due to the emergence of a new elite, the Working Rich, this new work focuses on wealth and offers a very different diagnostic by showing the resurgence of capital in its most traditional form: inheritance. The various forms of inequality are morally and politically ranked by the frequent use of the concept of merit, a concept difficult to define – and not specified here – sometimes used to describe the collective perception (an emic conception), sometimes that of the analyst (an etic conception). According to the author, wealth inequalities (particularly those that are inherited) violate merit more than income inequality, which contravene merit more than wage inequality.

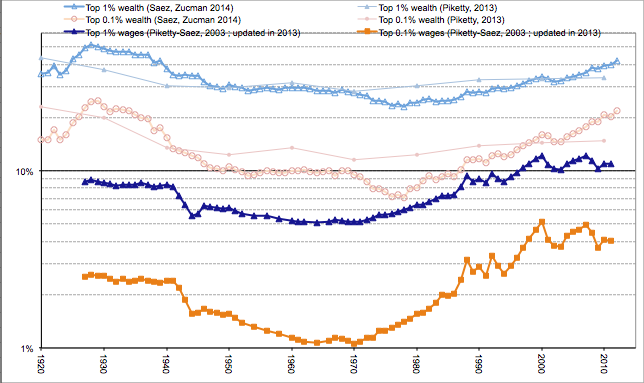

Although the resurgence of capital is a proper cause of concern, especially for political and moral reasons, should we consider it as the most prominent transformation of contemporary inequalities? Certainly, wealth inequalities are more pronounced than income inequality. But in light of the data presented, their recent growth in the US is much more limited than that of wages. In 2010, the share of the top 1% in wealth is 1.3 times larger (in terms of odds ratios) than it was in 1970. Over the same period, the share of the top 1% in wages increased by a factor of 2.3. Measured by this yardstick, the emergence of the Working Rich is a more radical transformation than the resurgence of capital. However, it seems that the author, rigorously reasoning his way through incomplete data, has had the remarkable intuition of a phenomenon that the available data only showed imperfectly.

Hence, in a recent work, Gabriel Zucman and Emmanuel Saez (2014) reestimate wealth composition from income tax. This method requires one to make many assumptions to estimate stocks from flows and we must remain careful. Nevertheless, they establish remarkable results that fill in the missing piece of Thomas Piketty’s book. According to these new estimates, the top 1%’s share of wealth has increased 1.5 times between 1970 and 2010, moving from 28% to 37% of total US wealth and that of the top 0.1% increased by 2.3 between 1970 and 2010, moving from 10% to 20%. If Emmanuel Saez and Gabriel Zucman’s work holds true, then there is indeed a real resurgence of wealth inequality, moving back to its 1920 level. Nevertheless this is smaller in relative amplitude than the rise of the Working Rich: the share of the top 0.1% of wages increased during the same period by 3.9, moving from 1.1% of payroll to 4.1% (Figure 2). It is true that the interpretation of the comparison of two evolutions of percentage depends dramatically on the choice of the metric: additive (+10 percentage points for wealth versus +3 percentage points for wages) or multiplicative (as I do here: *2.3 for wealth versus *3.9 for wages). However, whatever the metrics, the complexity of recent changes in inequality is due to the necessity to think them as both the product of the return of capital and the rise of the Working Rich.

Figure 2. Comparison of the evolution of wealth inequality and wage inequality in the United States

Note: The top 0.1 wage share amounted to 1.1% of payroll in 1970. Sources: for salaries; for wealth.

Tweets (rarely/rarement): @OlivierGodechot

HOP

A CMS

000

clics / mois.